Rev. Bruce G. Epperly, PhD

The Celtic spiritual tradition is replete with stories of monks, who set off on the high seas in small boats, coracles, in search of their place of resurrection. Without a rudder, they depended on God’s grace alone to guide them in the winds and waves and provide a way to their true spiritual home, the place where they could experience eternity in the world of living and dying.

Rev. Bruce G. Epperly, PhD

Lent is a time of letting go, similar to retirement. We look at our lives, consider our relationship with God and our neighbor, and prune away everything that prevents God’s energy of love from flowing into our lives and to the world around us.

Rev. Bruce G. Epperly, PhD

Without a vision, we become directionless. With a too structured agenda, we succumb to worry and busyness. Read Bruce Epperly’s answer to poet Mary Oliver’s question, ““What is it that you plan to do with your one wild and precious life?”

Rev. Bruce G. Epperly, PhD

In my first piece in this series (March 2022), I began with a quote from United Nations Secretary-General Dag Hammarskjold (1953-1961), whose book Markings I read each year, either on New Year’s Day or my Fall birthday. This year I read it on my seventieth birthday.

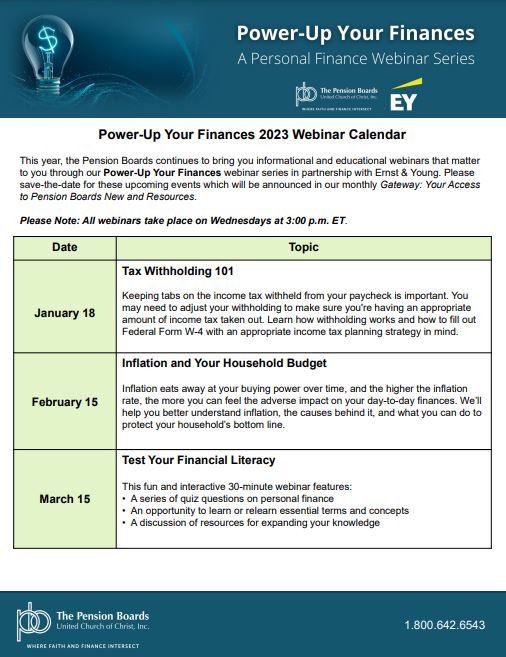

The Pension Boards brings you informational and educational webinars that matter to you through our Power-Up Your Finances webinar series in partnership with Ernst & Young. Please add these upcoming events to your calendar. Read more.

The Pension Boards brings you informational and educational webinars that matter to you through our Power-Up Your Finances webinar series in partnership with Ernst & Young. Please add these upcoming events to your calendar. Read more.