In this Q&A article, the Pension Boards outlines the benefits and risks of investing in Target Date Funds and shares why you, the member, should take advantage of the Pension Boards’ Target Annuitization Date (TAD) Funds. The TAD Funds automatically reallocate your investments in line with your anticipated annuitization date, and when you annuitize, they are converted to a defined benefit annuity – an option not provided through other plans in the financial services marketplace.

Q: What are Target Date Funds (TDF)?

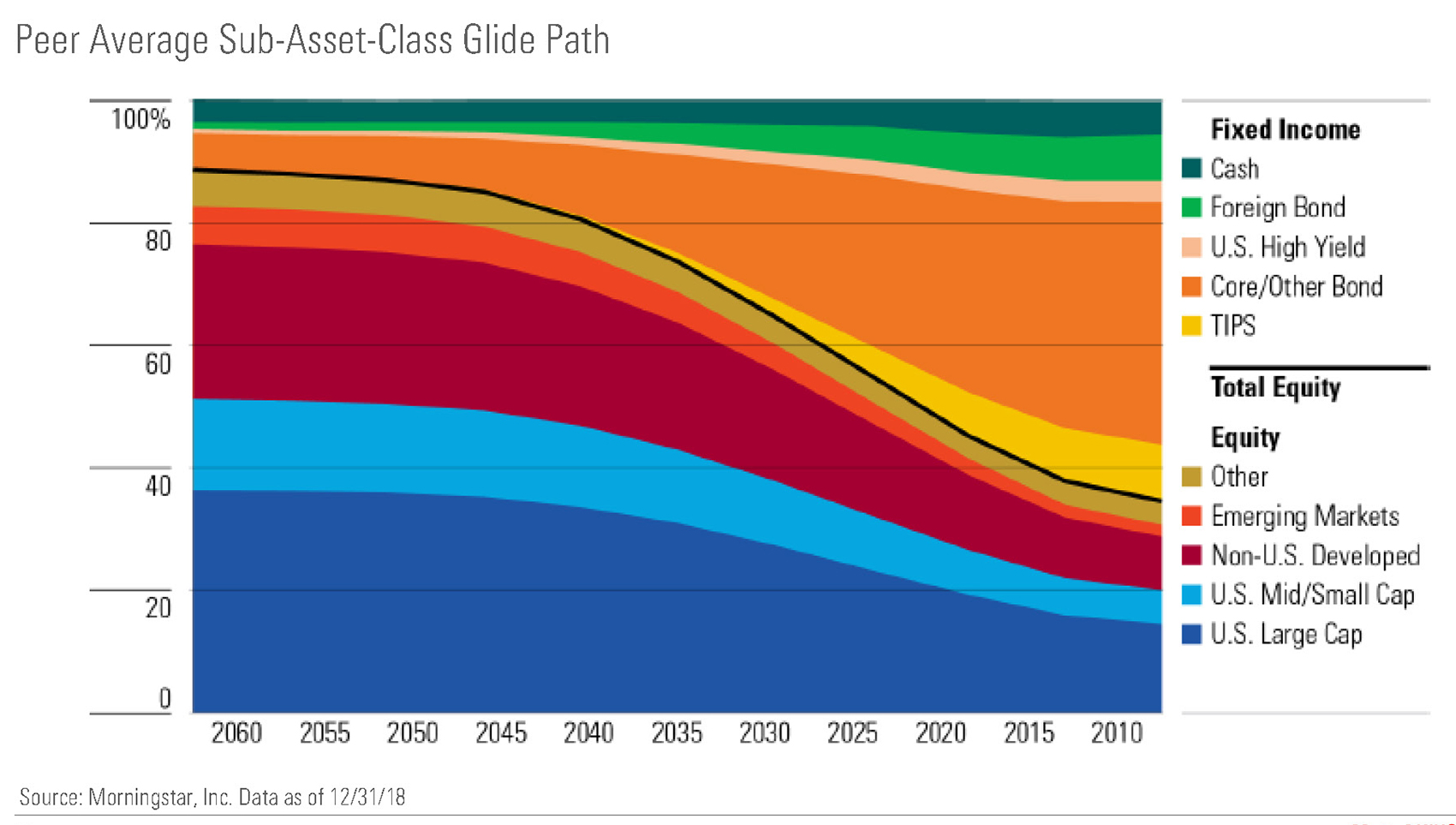

A: A TDF, also known as a lifecycle, dynamic-risk, or age-based fund, is a simple investment solution that rebalances the asset allocation and risk of a member’s portfolio using a “glidepath” tool for the member’s life stages. The asset allocation mix becomes more conservative as the target date – typically one’s expected date of retirement – approaches.

Usually, individuals can take greater investment risks when they are younger through a higher allocation to equities. As they grow older, their investments will automatically become more conservative, with investments in fixed-income securities and cash. The glidepath tool is used by the portfolio manager to adjust the asset allocation accordingly among sub-asset classes of equity, fixed income, and cash.

Q: How has the market for TDFs grown?

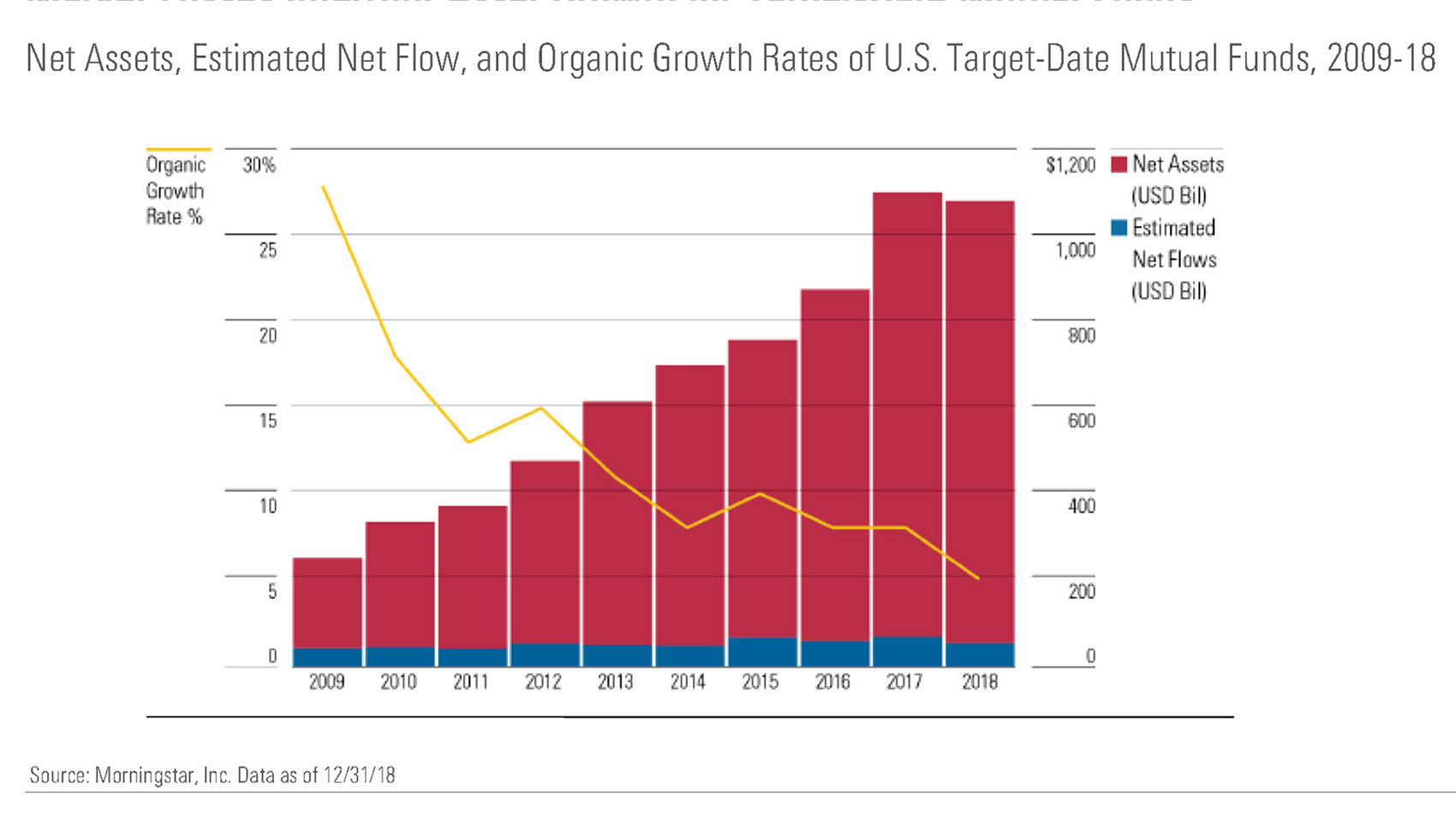

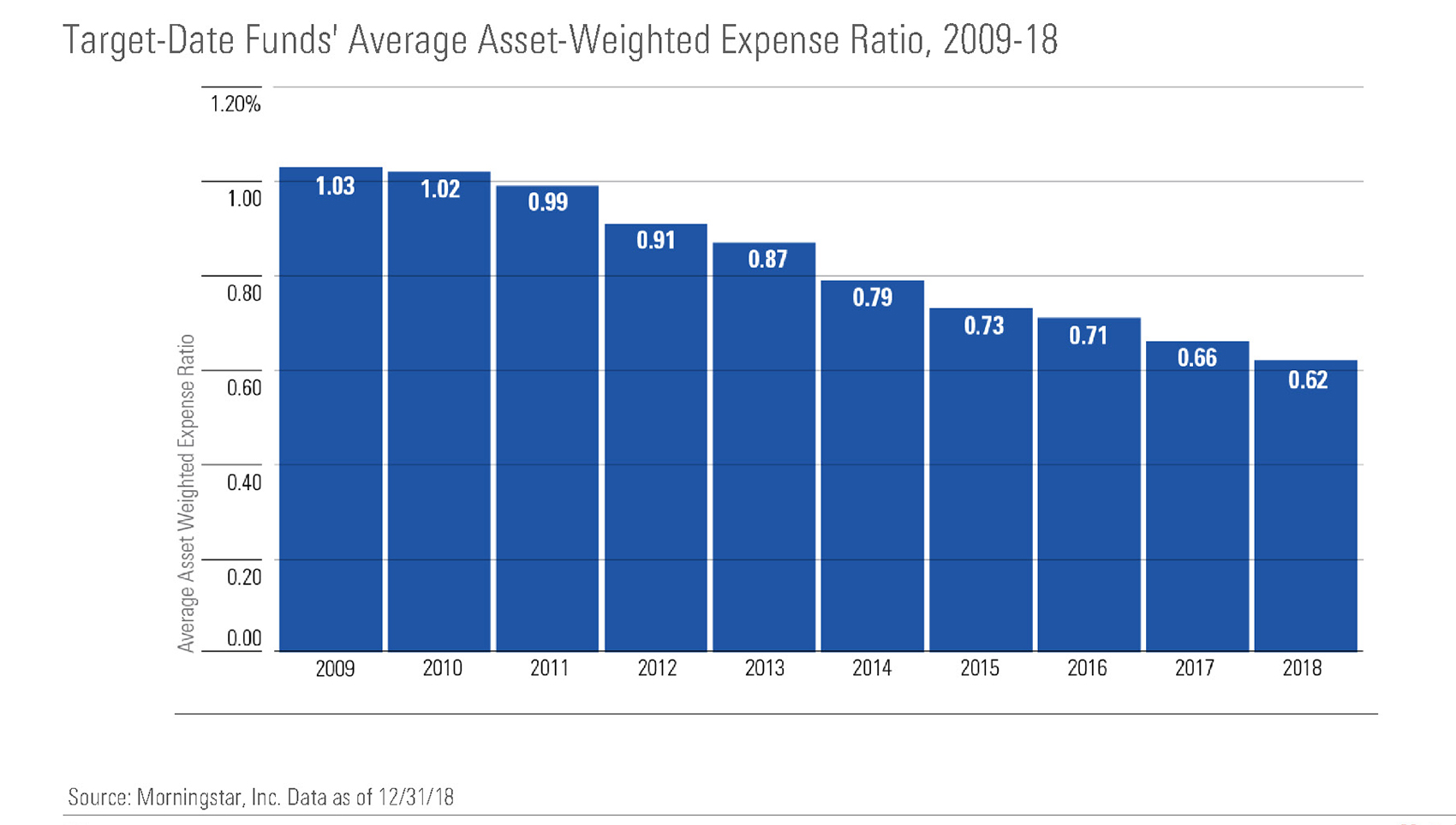

A: TDFs currently account for $877 billion of the $3.2 trillion U.S. mutual fund assets in defined contribution plans. The total of all target date strategies in the U.S. in investment vehicles including mutual funds, separate accounts, and commingled trusts is $1.7 trillion. The growth can be partially attributed to TDFs becoming the default option for plan sponsors, the ease of auto asset allocation, and lower fees. Currently, over 85% of plan sponsors use Target Date Funds as their default option.

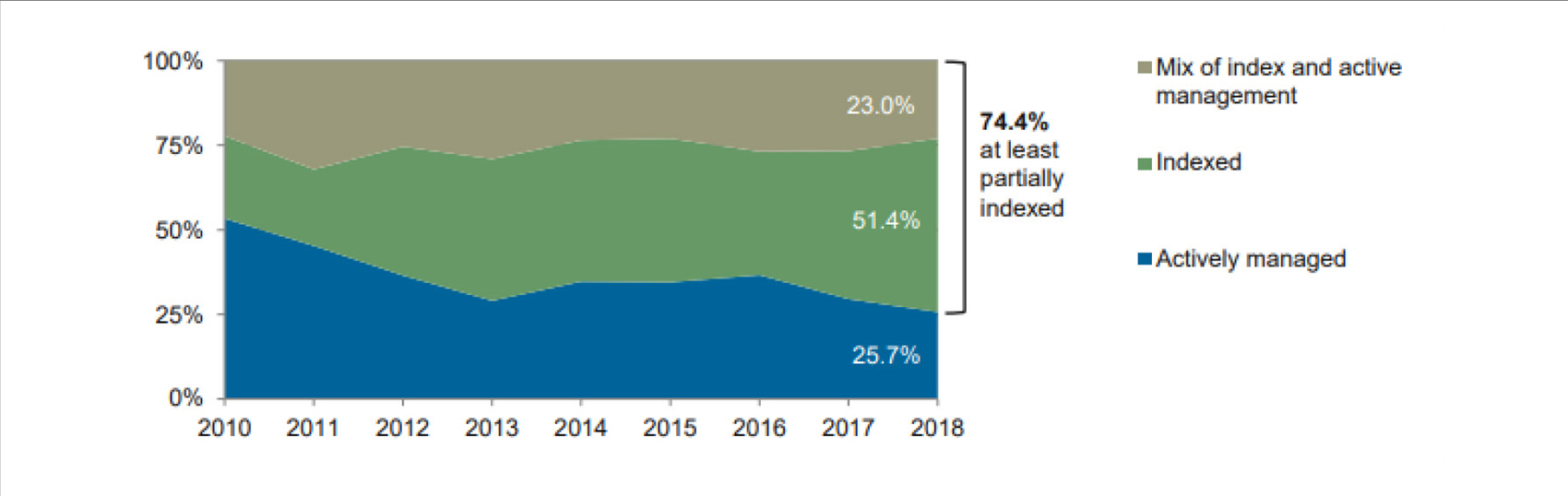

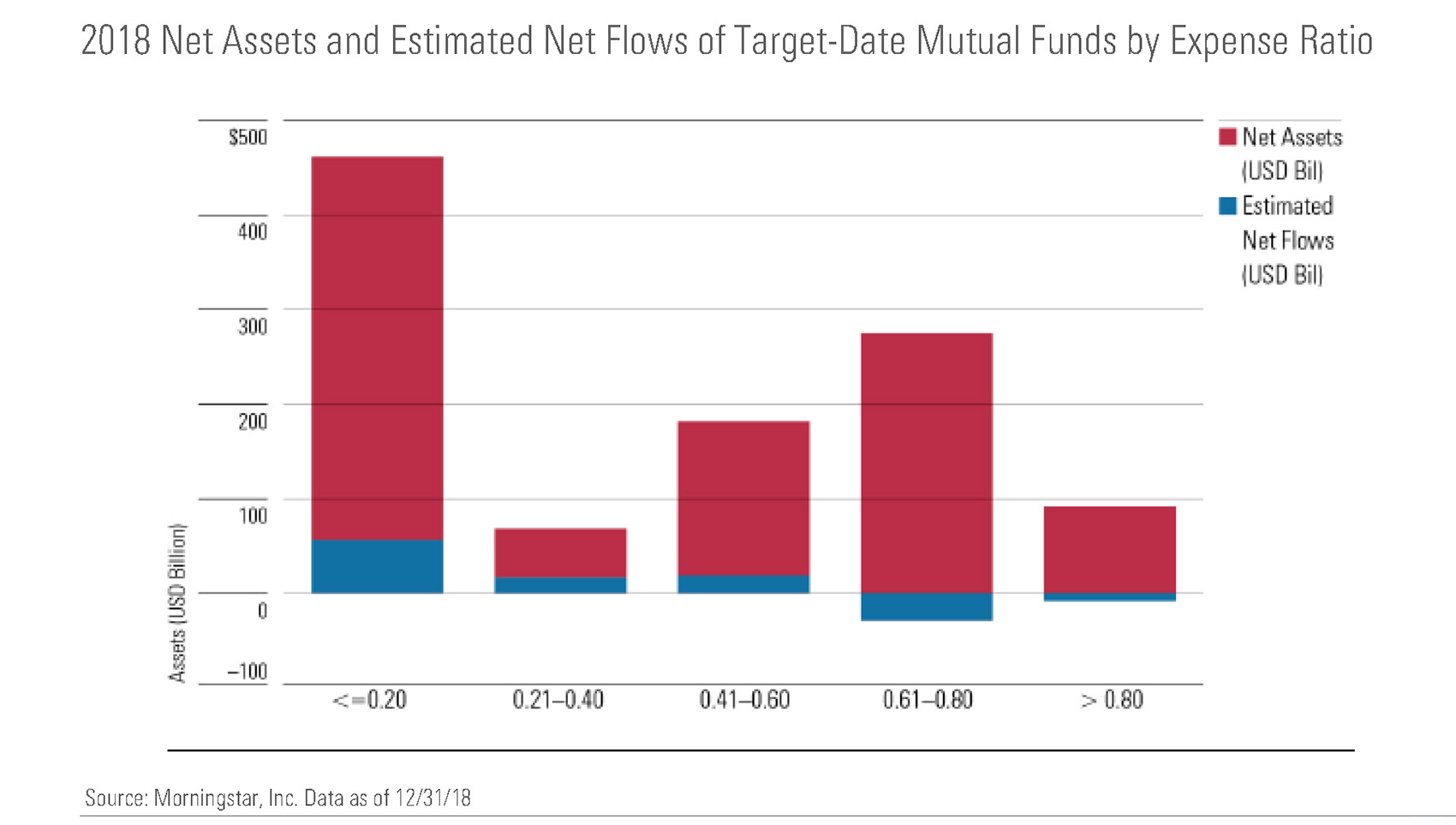

With the focus on fees, the allocation toward passive investments (investments that track a broad market index) has increased. The low-cost leader is Vanguard. Others in the top five in terms of assets include T. Rowe Price, Fidelity, BlackRock, and JP Morgan.

Over the course of the past decade, a confluence of trends favoring low-cost, passive investments has driven assets out of active TDFs and into passive ones.

First, there has been a growing focus on investment fees. Second, passive TDFs have benefited from the performance tailwinds enjoyed by passive equity strategies in general. Actively-managed funds have outperformed in more volatile times, when stock prices are generally declining. Finally, many plan fiduciaries believe that selecting passive TDFs for their plans is both a safer fiduciary choice and one that helps protect them from expense-related, class-action litigation.

Market environments change and the performance tailwinds for passive investments are not likely to go on forever. In turn, active management (fund managers make investments with a goal to outperform a benchmark with lower risk), in both equities and fixed-income securities, may be poised for a period of outperformance.

Q: What are some of the risks of investing in TDFs?

A: TDFs are not personalized to individual’s changing goals and needs. Also, as people live longer (longevity risk), they may not have enough funds to live out their retirement years.

For investors, passive funds can reduce potential for excess returns versus the market, reduce risk mitigation, and reduce the benefit of increased asset class diversification. This is especially true in changing market environments. Low fees do not guarantee superior results. For the plan sponsors, passive does not offer blanket protection against class-action litigation.

Q: What Target Annuitization Date (TAD) Funds does PBUCC offer and how are they allocated?

A: The Pension Boards offers five TAD Fund options based on individual age and expected retirement dates. We predominantly use an active approach to the allocation to asset classes and managers, to be more aligned with the needs of our members. We tend to passively invest in those areas where there is not a lot of alpha or excess return opportunity.

Similar to commercially-available TDFs, our TAD Funds are based on expected date of retirement. They are called TAD Funds because the funds annuitize into a defined benefit annuity plan for participants. Many other plans do not provide this option.

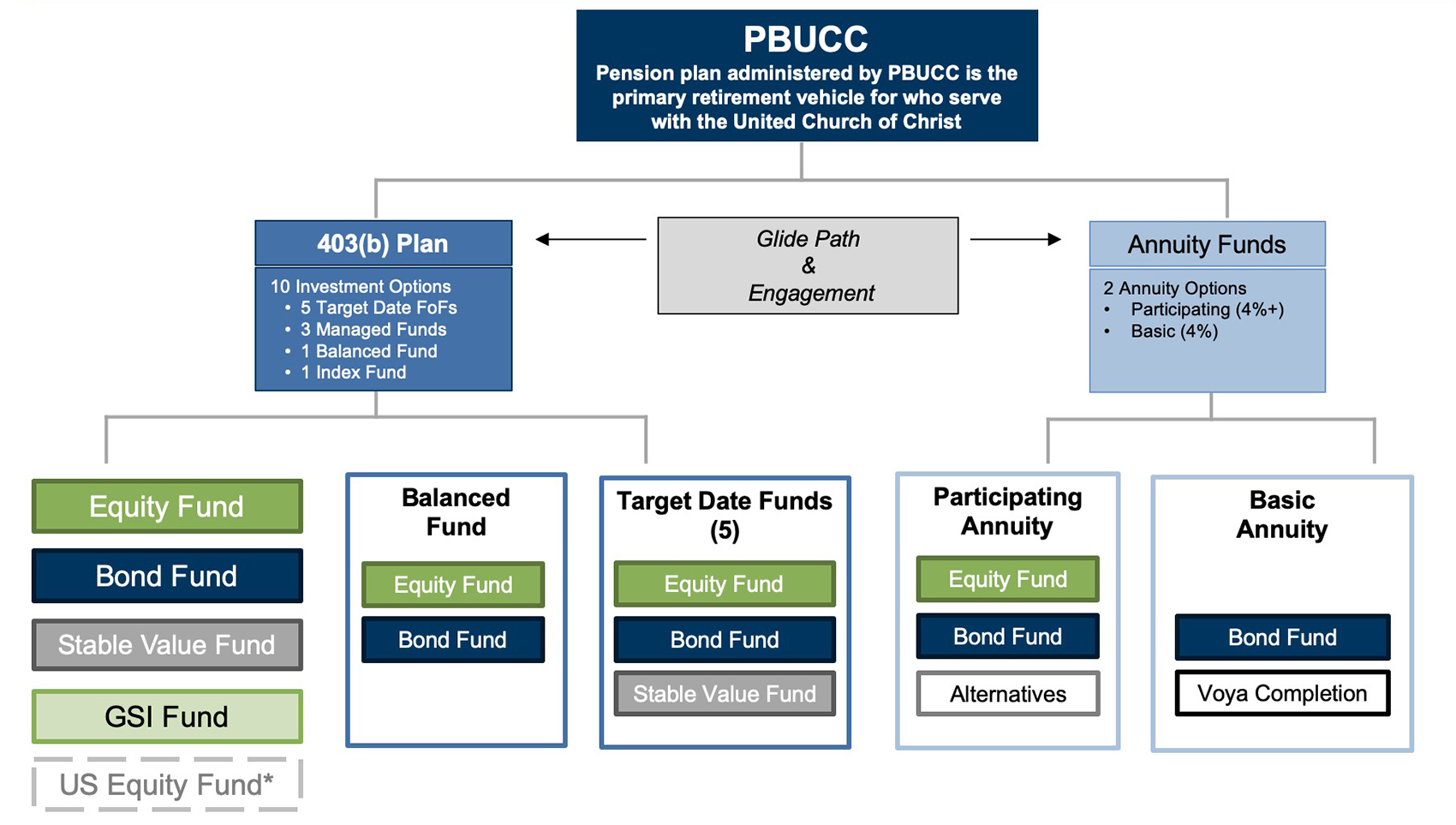

Below is an illustration of all our accumulation funds (including TADs) and annuities.

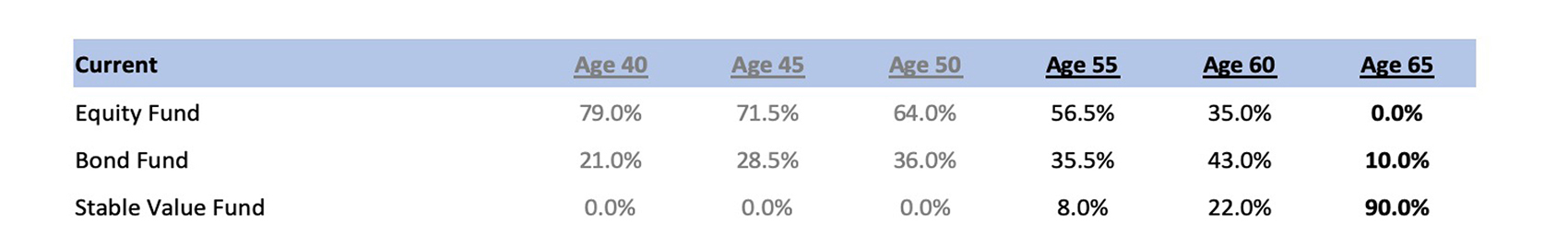

Below is the glidepath for our funds. As you will note, the younger you are, the more investment risk you can take by investing in the Equity Fund. As you grow older, the percentage of these riskier investments drops while assets are allocated to the more conservative Stable Value Fund. Placing your investments in a TAD Fund makes your investing simpler since you won’t have to reallocate your portfolio during the different stages of your life.

For more information about investing in TAD Funds, please contact Member Services at 1.800.642.6543.