With the Pension Boards-United Church of Christ (PBUCC) mission of Faith and Finance, the investments team has been engaged in responsible investing by doing good and doing well for its members.

With the Pension Boards-United Church of Christ (PBUCC) mission of Faith and Finance, the investments team has been engaged in responsible investing by doing good and doing well for its members.

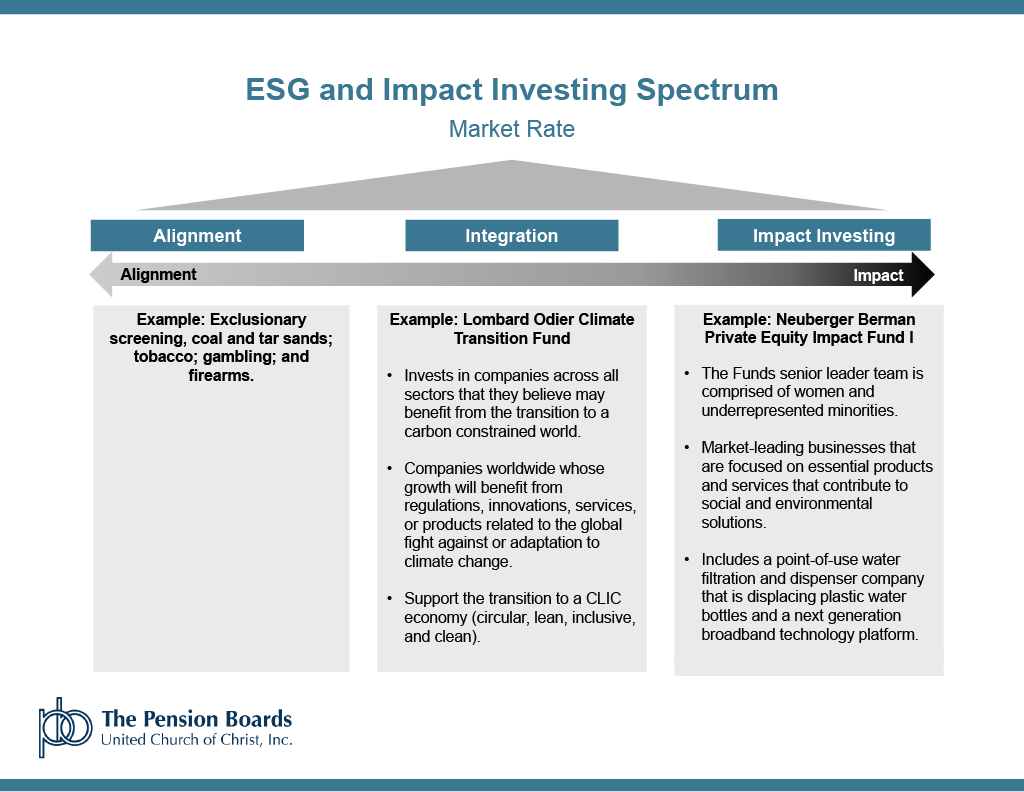

As investors across the world recognize the materiality of social and climate change risks within their portfolios of investments, the Pension Boards has taken steps towards managing these Environmental, Social, and Governance (ESG) risks in our members’ portfolios by identifying, assessing, and reporting on these risks. The Investment Team integrates ESG criteria throughout their investment processes, applying a sustainable lens to their portfolio allocation decisions, investment strategies, and active ownership practices. This includes exclusionary screens, ESG integration by our managers, and impact investing.

We would like to highlight two managers that have done a particularly good job at aligning their investments with the Pension Boards’ ESG mission and goals — Lombard Odier Investment Management’s Climate Transition strategy and Neuberger Berman’s Private Equity Impact Fund I:

Lombard Odier Investment Management Climate Transition Fund

In early 2021, the Pension Boards re-launched a Sustainable Balanced Fund (SBF) for accumulating members that excludes non-sustainable companies and industries, but also seeks to incorporate managers that proactively invest in companies that are leaders in sustainability-related efforts. One of the strategies included in the SBF portfolio is Lombard Odier Investment Management’s Climate Transition strategy. The strategy consists of a global portfolio of 40-60 stocks that they believe will benefit from the transition to a carbon-constrained world. They focus on finding companies worldwide whose growth will benefit from regulations, innovations, services, or products related to the global fight against or adaptation to climate change. For example, they have recently added Nike to their portfolio. The company has set a goal for 2025 to use 100% renewable energy in owned and operated facilities. To keep their carbon footprint as small as possible, Nike is sourcing innovative low-impact materials and using recycled polyester in their products. As part of the investment process, the Lombard Odier team is directly engaging with their portfolio companies on achieving net-zero emissions by developing transition plans, and targets while limiting risks.

Neuberger Berman Private Equity Impact Fund I

The Pension Boards currently offers two life-time retirement income options, the Basic Annuity and Participating Annuity. The Participating Annuity includes a 10-15% allocation to private markets. Three areas of focus in private markets include healthcare access, education and human capital, and resource/climate. A fund we would like to highlight is the Neuberger Berman Private Equity Impact Fund I. The investment strategy seeks to achieve positive social and environmental outcomes that are aligned with the UN Sustainable Development Goals by investing in primary, secondary, and co-investment opportunities in the private markets. Examples include:

- a point-of-use water filtration and dispenser company that is displacing plastic water bottles;

- a next generation broadband technology platform; and

- an online tutoring solution that delivers both high-quality and affordable tutoring to K-12 students.

Neuberger Berman has done a good job so far at evaluating investments in the private equity area, with great impact investments that have been highly profitable.

This fund has enabled the Pension Boards to have access to private equity investment opportunities that provide significant positive climate and social impact. In addition, the funds senior leadership team is comprised of women and other leaders from underrepresented groups in the financial system. This aligns with the Pensions Boards mission and values of diversity and inclusion at all levels of management.