The Sustainable Balanced Fund seeks to provide long-term growth of principal and income.

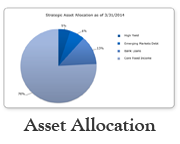

This Fund is suitable for investors who are willing to accept a greater degree of short-term principal and income volatility for a portion of their assets than will be typical of the Stable Value Fund or the Bond Fund, in pursuit of long-term growth of principal and income. This Fund, however, will typically be less volatile than the Equity Fund and the two longer dated Target Annuitization Date Funds. This Fund is also suitable for investors seeking a fund in which The Pension Boards will manage the allocation of asset classes approved by the Investment Committee. Under normal conditions, between 40% and 70% of the Fund’s assets will be invested in stocks, 30% to 60% will be invested in bonds and 0% to 10% will be invested in alternative assets.

Over long periods of time the return to investors in this Fund should exceed the return to investors in the Stable Value Fund, the Bond Fund, and the two shorter dated Target Annuitization Date Funds but it should fall short of the return to investors in the Equity Fund and two longer dated Target Annuitization Date Funds. However, over shorter periods of time, returns to investors in this Fund could be less than the returns to investors in the other Funds, and at times they may be negative.

The Fund achieves broad diversification by investing in units of the Bond and Equity Funds. Alternative assets are permitted up to limits established by the Investment Committee and subject to Investment Committee approval and may include private equity (buyouts, venture capital and debt including distressed), real assets (real estate, timber, natural resource based assets) and hedge fund strategies (which may include arbitrage, relative value, directional and event-driven strategies). Futures guidelines are provided in The Investment Guidelines.

Manager(s) - click here for list of Fund managers

Fee Disclosures

Historical Policy Benchmark

To access another Fund profile, click on Fund name below.