Investment Review

The investment landscape can seem confusing to those who don’t follow it every day, and sometimes to those who do. In 2018, market volatility returned as the global economy slowed, following a strong 2017.

The year began with solid global fundamentals, undoubtedly aided by a one-time U.S. tax cut during a period of full employment. By mid-2018, international developed and emerging market economies (and markets) began a decline made worse by political uncertainties and trade tensions. The U.S. seemed to buck this global trend, with equity markets defying gravity through September. However, in October, market sentiment changed as U.S. companies began to reduce earnings forecasts due to higher interest rates, wage pressures, a strong dollar, and trade tariffs. Domestic equity markets then suffered a December swoon, which had the feel of a panic. Global equity markets ended 2018 in negative territory, and no major asset class in the world (including bonds) was up more than 5%.

International equity markets were weak throughout most of 2018. Emerging markets started the year very strong, but geopolitical tensions around trade wars, North Korea, Iran, and Italy’s new populist government led to mid-teen declines through the third quarter. Emerging markets outperformed U.S. markets substantially in the fourth quarter, highlighting the benefits of diversification.

Large U.S. companies, as represented by the Standard & Poor’s (S&P) 500 Index, declined 4.38% in 2018 after being up over 11% by the third quarter. The Russell 2000® Index, which measures the performance of small-cap U.S. companies, declined 11.01% in 2018 after being up 14.65% in 2017.

Now to the other side of the asset ledger – fixed-income investments.

Bonds, as represented by the Barclays Capital U.S. Government/Credit Index, were down 0.42% in 2018. The Federal Reserve (Fed) raised interest rates four times in 2018 in response to solid gross domestic product (GDP) growth and low unemployment. In a further sign of volatility, the yield on 10-year U.S. Treasury notes went from 2.46% at the beginning of the year to 3.23% at the beginning of October but ended the year at 2.69%, as markets sought the safe haven of U.S. government bonds.

The Pension Boards leveraged its flexibility and moved into cash to reduce equity exposure in the balanced funds to mitigate some downward movement in the markets. Thus, asset allocation decisions were generally positive during the year. Although manager contributions to performance were limited in 2018, some of the more defensive, value-oriented managers protected capital in a volatile period. All in all, it was a disappointing year.

Accumulation Fund Performance

The following are charts illustrating fund performance for various periods as of December 31, 2018. Asset allocation at year-end is shown as well. Fund performance, as shown, is net of all expenses. Indexes are unmanaged benchmarks with no associated fees.

Click on the tabs to view the charts.

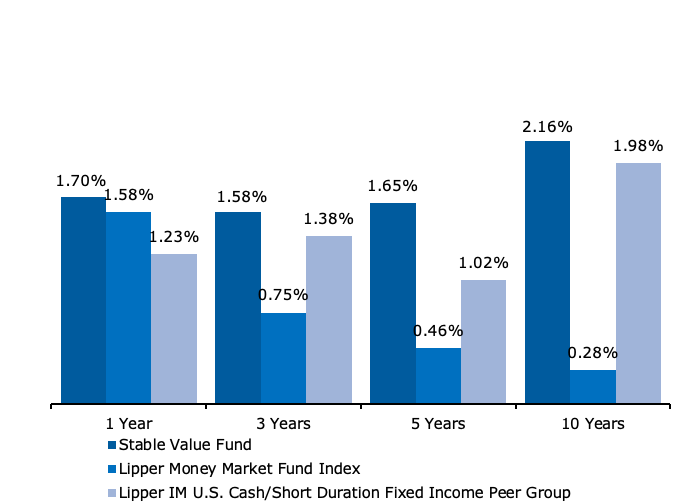

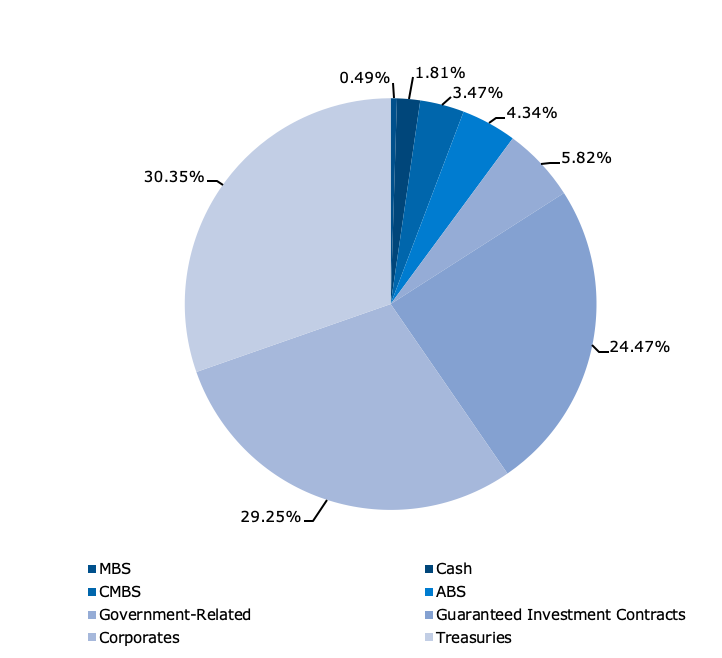

Stable Value Fund

Fund Performance

Asset Allocation

For 2018, the Stable Value Fund had a total return of 1.70% versus 1.58% for the Lipper Money Market Fund Index. The Stable Value Fund has continued to maintain a higher yield than the Lipper Money Market Fund Index, as money market yields only started to rise in 2018. The Fund seeks a principal preservation strategy that expects to maintain a stable unit value of $1.00 per unit while earning a level of income that is consistent with short and intermediate-term bonds.

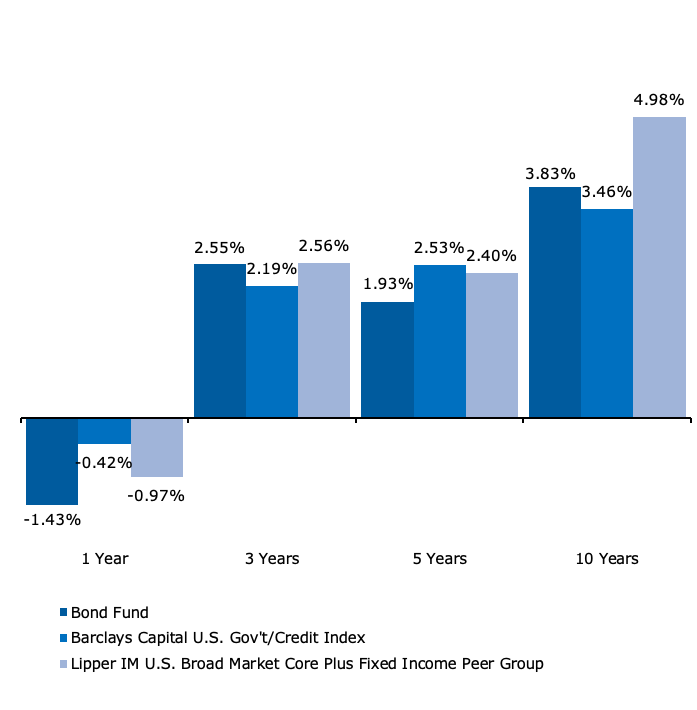

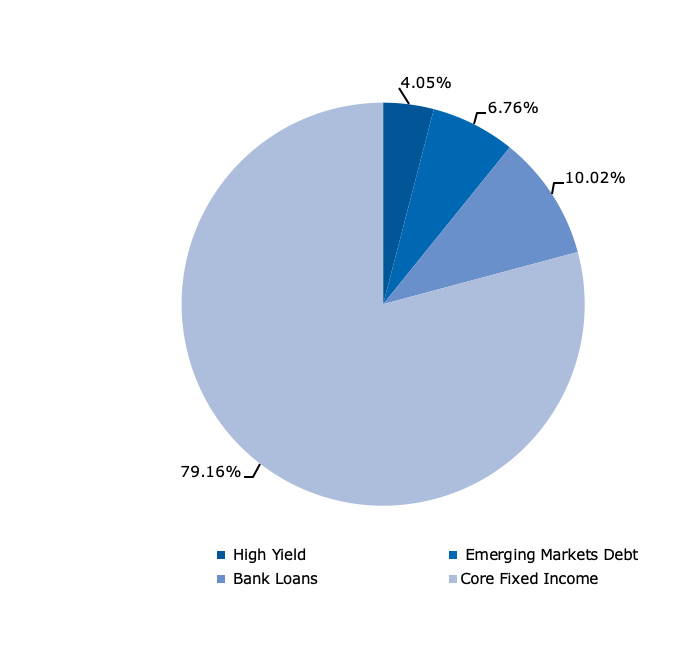

Bond Fund

Fund Performance

Asset Allocation

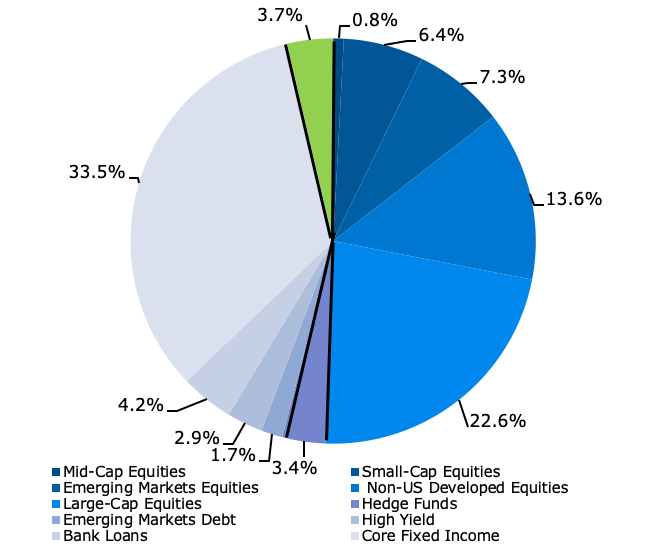

In 2018, the Bond Fund had a total return of -1.43% versus -0.42% for the Barclays Capital U.S. Government/Credit Index. The Fund underperformed the benchmark, which reflects investments in U.S. treasuries and corporate bonds only. Underlying managers, both internal (Core fixed-income), and external (emerging markets debt, bank loans, high yield), had a tough year, lagging benchmarks. Fundamentals were supportive through the third quarter but fourth quarter Fed comments to increase interest rates and reduced liquidity resulted in a flight to safety and a loss in accumulated returns. The investment in bank loans was additive to the overall performance in 2018, although the manager, Voya, underperformed the leveraged loan benchmark slightly, net of fees.

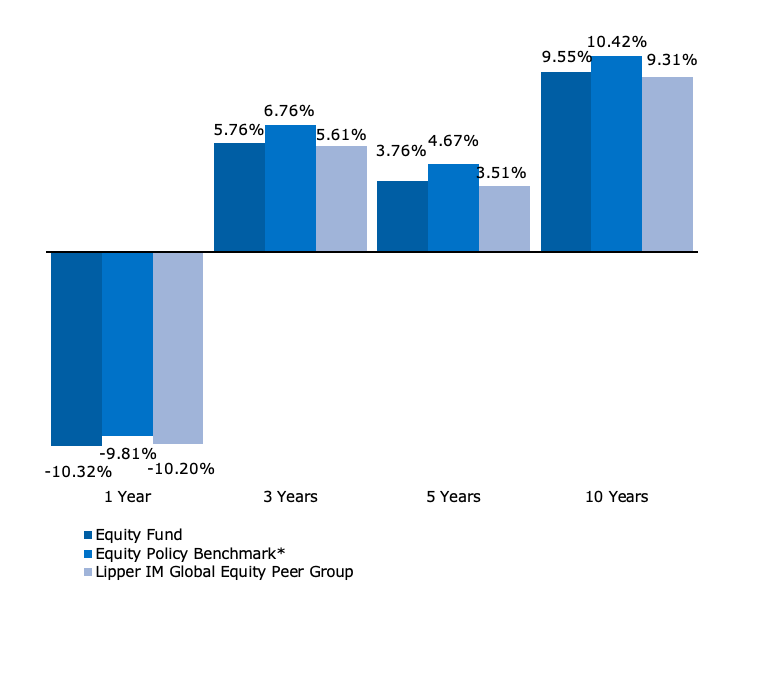

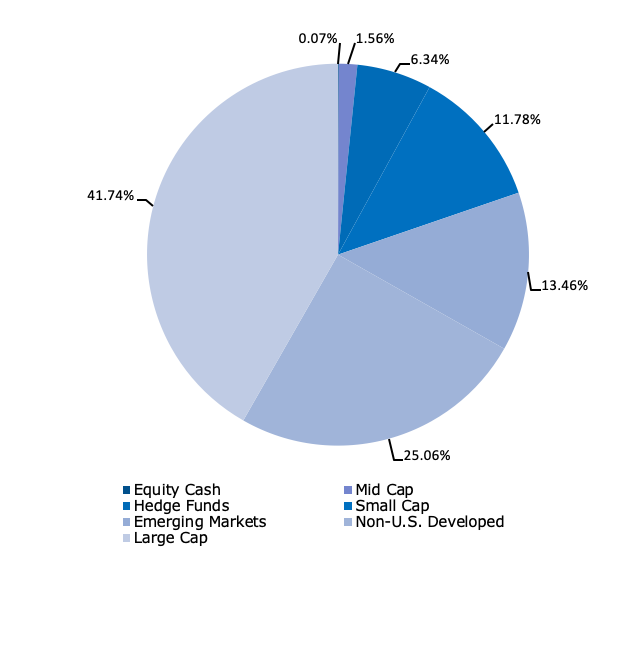

Equity Fund

Fund Performance

Asset Allocation

In 2018, the Equity Fund had a total return of -10.32% versus -9.81% for the Equity Policy Benchmark. The Fund’s underweight to International Equity and International small cap benefitted the portfolio, while overweights to emerging markets equity and U.S. small cap detracted but not enough to negate the benefits. The Russell 1000 Index®, for U.S. large cap stocks, and the Russell 2000 Index®, a similar index for U.S. small cap stocks, had total returns in 2018 of -4.78% and -11.01%, respectively. International stocks in developed countries, as represented by the MSCI EAFE Index, returned -13.79%, and emerging markets stocks returned -14.57%. As the allocation chart illustrates, the Equity Fund is diversified to include small, medium, and large U.S. stocks, as well as developed international and emerging marke stocks, and hedge fund investments. The Fund benefited from allocations to managers like Walter Scott and William Blair in small/mid cap growth, and to hedge funds. International managers Dodge & Cox and GlobeFlex, and emerging market manager Lazard were the largest detractors.

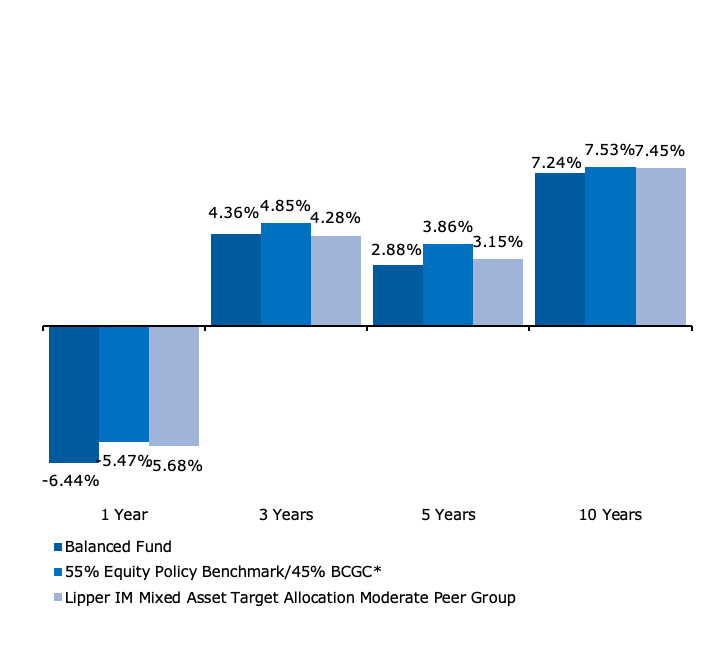

Balanced Fund

Fund Performance

Asset Allocation

In 2018, the Balanced Fund had a total return of -6.44% versus -5.47% for the Policy Benchmark. The Balanced Fund invests in the Equity and Bond Funds. The Fund had a lower return than the benchmark return, as the underlying Equity Fund and Bond Fund underperformed benchmarks. Asset allocation decisions were generally favorable as an increased allocation to cash outpaced equities and fixed income for the year.

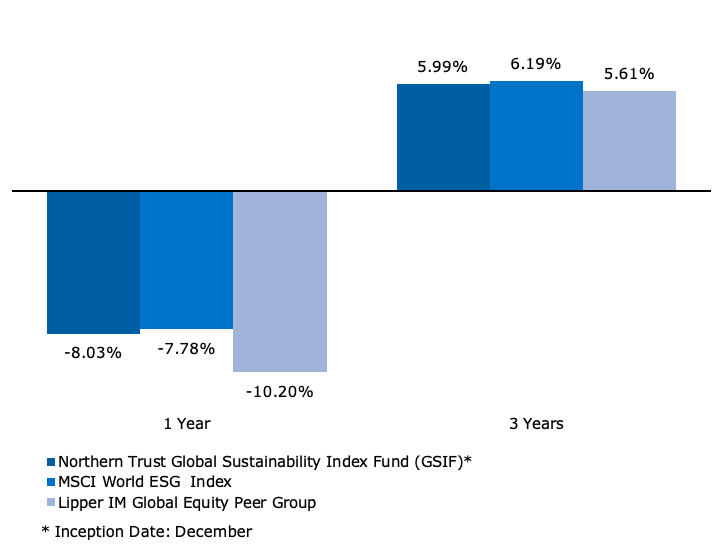

GSIF Fund

Fund Performance

In 2018, The Northern Trust Global Sustainability Index Fund (GSIF) had a total return of -8.03% versus -7.78% for the unmanaged MSCI World ESG Index. This Index Fund invests primarily in a broadly diversified portfolio of domestic and international equity securities further diversified by market capitalization, sector, and style. In addition, the GSIF is a registered mutual fund that utilizes one of the best-known measures of ESG (environmental, social and governance) factors. The Fund is indexed to the MSCI World ESG Index, which it seeks to replicate.

TAD Funds

| Target Annuiatization Date Fund | One Year | Three Years | Five Years | Ten Years |

|---|---|---|---|---|

| 2020 | -0.49% | 3.57% | 2.69% | 6.63% |

| 2025 | -4.35 | 4.60% | 3.21% | 7.56% |

| 2030 | -6.34% | 4.64% | 3.22% | 7.88% |

| 2035 | -7.00% | na | na | na |

| 2040 | -7.64% | na | na | na |

As the target date approaches, a higher allocation is given to the Bond and Stable Value Funds and less to the Equity Fund, which is more volatile than the other two Funds. Asset allocation is adjusted at least twice a year to conform to the established allocations. The performance of the TAD Funds reflects the underlying performance of the Funds in which they are invested. In a tougher year for financial assets, we believe the TAD Funds achieved their objectives.

Market Outlook

Looking forward, we believe that economic worries may be overdone. The U.S. economy has moderated as the benefits of tax stimulus abate, but we do not think a recession is likely now. After the selloff, global equity valuations are favorable, with emerging markets especially attractive. Many emerging markets also have the tailwind of growth stimulus from China and could be set to outperform the U.S., even more so if the dollar weakens. Risks remain due to anticipated Fed rate hikes, but the pace of these hikes may slow. Political uncertainty in Europe and a worsening trade outlook are also on the radar as concerns. As for fixed income, our interest rate sensitivity (duration) needs to be nimble given these cross-currents. As a result, a focus on diversification should continue to be the best discipline. We will build on the asset allocation decision capability and tools that helped our Funds in 2018, especially if volatility continues.

Selecting skilled managers, with low management fees, is also essential to delivering the returns you expect. Providing these returns proved more difficult in 2018, as only 30% of professional equity managers industry-wide exceeded their benchmarks. We still believe in active security selection for a portion of our Funds, especially if the direction of markets remains uncertain.

We remain focused on employing our Faith and Finance lens to investing, and insisting on a focus on environmental, social, and governance factors in the investments our managers make. Above all, we will continue to be good stewards of investments on your behalf in this increasingly complex world.