The following presentations are delivered by the Pension Boards or by Fidelity specifically for PBUCC Members. Please add the dates below to your calendar and look for email invites prior to each scheduled event.

In addition to the presentations above that Fidelity is scheduled to present to PBUCC Members, Fidelity offers various financial wellness presentations throughout the year.

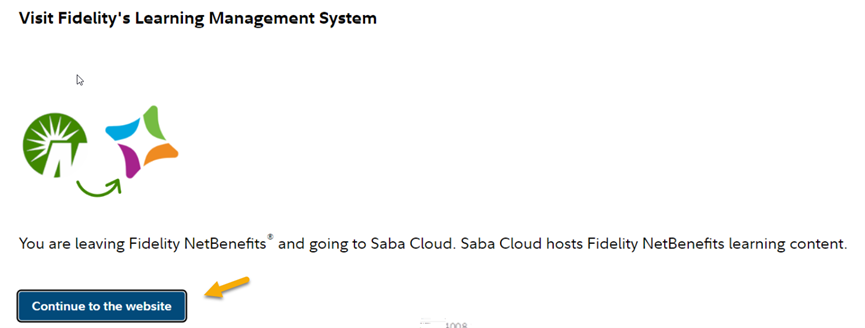

To view a full list of upcoming Fidelity webinars, go to PBUCC.ORG > Member Login > Access Fidelity NetBenefits® > Plan & Learn > Get Answers to Your Financial Questions > Join a Workshop > Browse > Calendar.

Please click the links below to tune into previously-recorded webinars.

| Topic | |

|---|---|

|

January 31 - Investment Watch |

|

January 24 - Planning for the Transition to Retirement |

| Topic | |

|---|---|

|

October 11 - Planning for the Transition to Retirement |

|

July 20 (Q2 2023 Investment Watch) |

|

April 20 |

|

January 19 |