Many are aware that the U.S. stock market started 2022 at elevated price levels, largely the result of gigantic monetary and fiscal stimulus in response to the pandemic. It was almost a given that when the Federal Reserve (Fed) started raising interest rates to combat high inflation, equity earnings multiples (prices investors pay) would come down. Yet, the reality of a double digit sell off (while not uncommon) is uncomfortable and makes retirement savers uneasy. To add to that uneasy sense of reckoning, bond markets (normally a source of refuge from equity market pain), have also sold off as interest rates have risen. On top of it all, more interesting albeit speculative investments like cryptocurrencies are no longer levitating. In short, the collateral damage has left few places to hide, short of fossil fuel investments.

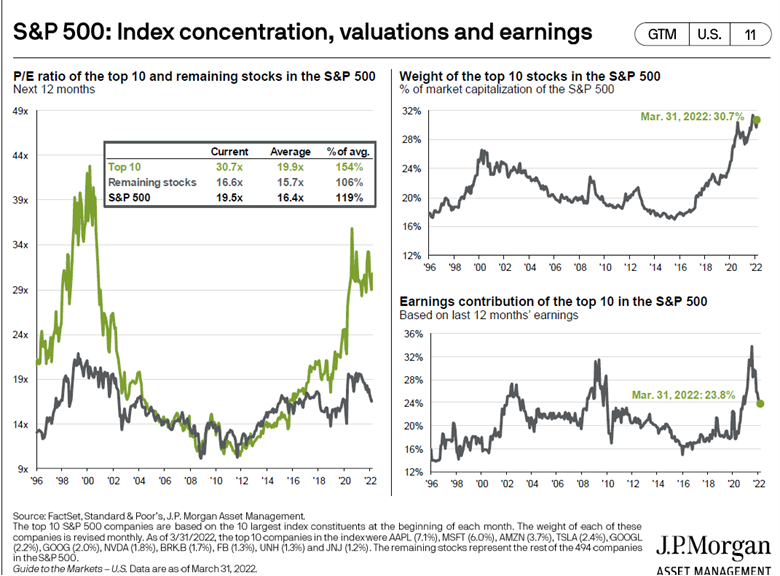

In reality, segments of the market started the correction in 2021, masked by the outstanding performance in the S&P 500 and Nasdaq technology leaders. It’s hard to ignore the phenomenon that market gains had been highly concentrated in a few select companies and industries. This is highlighted by the fact that the top 10 stocks accounted for over 30% of the S&P 500 index. As the earnings contributions from these top 10 declined from 35% to 23.8%, they led the market down. Investors have refused to pay a high premium for the top 10 and this has brought the market down to earth. This is illustrated in the charts below.

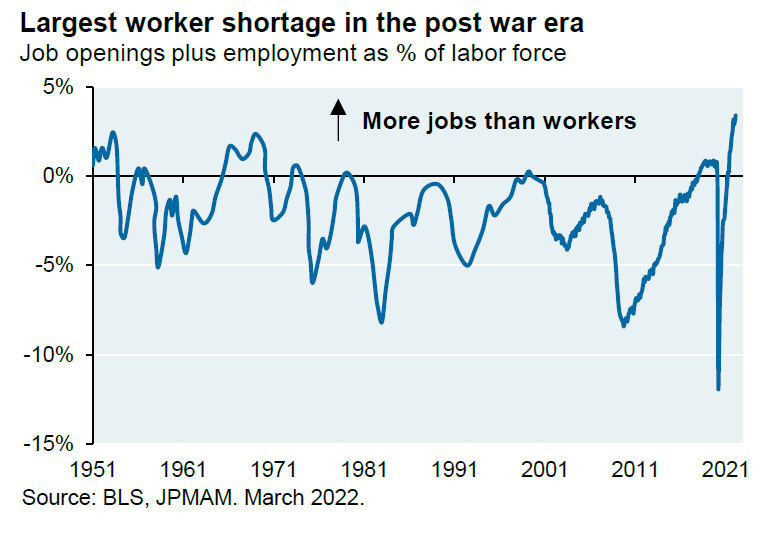

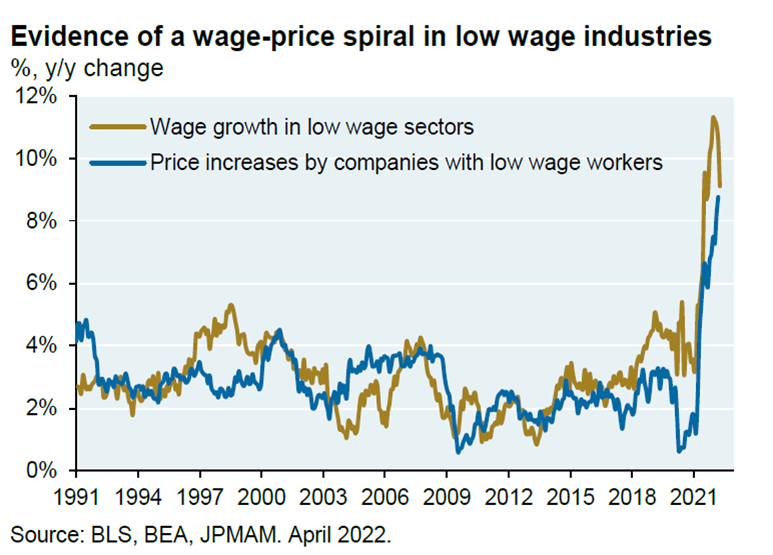

The Consumer Price Index (CPI) registered a reading of 8.5% for March 2022, which is a 40-year record high. A small decline to 8.3% in April made people wonder if inflation has peaked. With the Russian invasion of Ukraine, the China Covid lockdown, and the change from just-in-time inventory to just-in-case inventory, we believe inflation might not come down quickly. The U.S. is experiencing the largest worker shortage in the post-war era, and wage growth is finally happening, particularly for lower-salaried workers. Many will agree that wage growth is good, but it’s inflationary and may stay with us for some time. Again, see the charts below.

High market valuations, higher interest rates, and inflation are not the only risks to market returns. Geopolitical risk, and recession or stagflation risk (low growth, high inflation, last seen in the 1970s), would all affect financial markets.

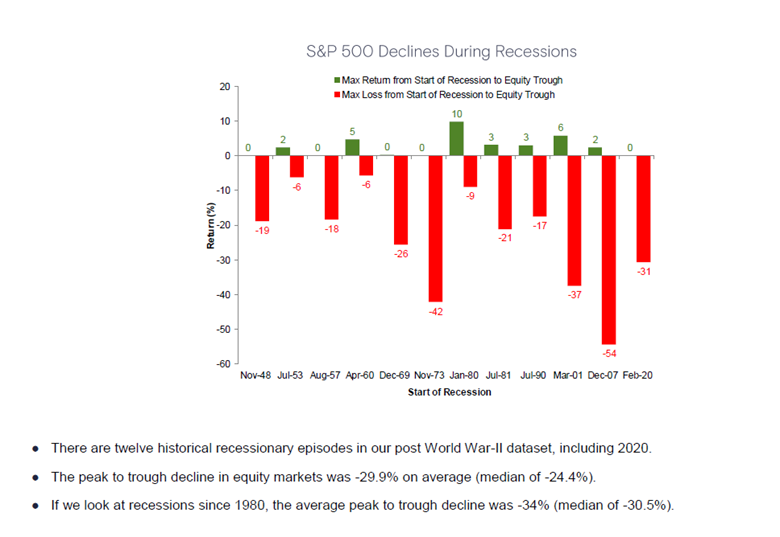

So the question for retirement savers is this: when will the market bottom? Borrowing from history, the peak to trough decline in equity prices is 30% on average during recessions. For some parts of the market, we are getting close to that level of decline. It’s noteworthy to point out that the U.S. is not in recession yet, despite one negative slide for the first quarter Gross Domestic Product (GDP).

In the Sustainable Balanced Fund, where we can adjust the mix of stocks, bonds and cash, our team reduced equity exposure after the strong market rebound in March, raising 5% cash for the Fund. In the Equity Fund, we employ hedge fund strategies designed to protect capital during market declines, and that has helped. In the Bond Fund, we utilize bank loans, as an asset class, which carry only small amounts of interest rate risk, and that has protected against declines driven by higher rates. And of course, actions taken in the Equity and Bond pools accrue to the Target Annuitization Date (TAD) Funds we often urge you to consider.

Your asset allocation, or mix of assets, is the most key consideration for you on the path to retirement. This can be accomplished in two key ways: 1) Locate the appropriate glidepath (TAD) Fund nearest to your retirement date. This is especially helpful if you are not a “do it yourselfer.” 2) Contact our capable and responsive Member Services staff at 1.800.642.6543 with questions about fund information, performance, strategy, and approach. If you have questions about your unique financial situation, please contact an Ernst & Young (EY) financial planner, available at no cost to you. Visit the EY Navigate™ website at https://pbucc.eynavigate.com/ or call the EY Navigate™ Financial Planner Line at 1.877.927.1047, Monday through Friday from 9:00 a.m. to 8:00 p.m. (ET).

We are here for you. As in prior periods of market volatility, we will get through this, and we will get through it together! Please let us know if we can be of further assistance.